Over the past decade, the regenerative medicine landscape has undergone an extraordinary evolution with the continuous growth of Advanced Therapeutic Medicinal Products (ATMPs). ATMPs are medicines for human use that are based on genes, tissues or cells. They treat the root cause of diseases and disorders by altering, augmenting, repairing, replacing, or regenerating organs, tissues, cells, genes and metabolic processes in the body. This means that they can offer potentially groundbreaking new opportunities to address unmet medical needs.

10 years ago, in 2014, the ATMP sector was starting to grow but several hurdles including development, manufacturing and regulatory challenges and uncertainties needed to be addressed. Back then the field was still in its infancy, with only a few approved therapies and a rapidly growing number of early stage development programmes. The FDA had approved a small number of cell therapies, including several cord blood-based products like Hemacord and Allocord. However, there were no FDA-approved gene therapies in 2014.1

So much has changed in a positive way for patients. In 2024, the ATMP sector has expanded significantly, with therapies now available for a diverse range of medical conditions and they have become more accessible. There have been major improvements in the development, manufacturing and supply chains of ATMPs that have helped more patients receive these lifesaving and life changing medicines. There are now multiple gene therapies on the market for rare genetic disorders, such as Spinal Muscular Atrophy and Duchenne Muscular Dystrophy.

The sector has made significant advancements in 2024, driven by positive regulatory approvals, breakthroughs in scientific research, manufacturing optimisations and progress in market access and pricing. ATMPs have already saved and improved many lives, for example, a treatment for spinal muscular atrophy, Zolgensma, has been delivered to over 3,700 children globally. The sector has shown robustness and promising foundations for continued sector growth in 2025 and beyond. Developers are not only focused on proving that therapies can work but, are placing increased emphasis on refining their effectiveness, reducing side effects, expanding their indications and addressing market access and cost challenges.2

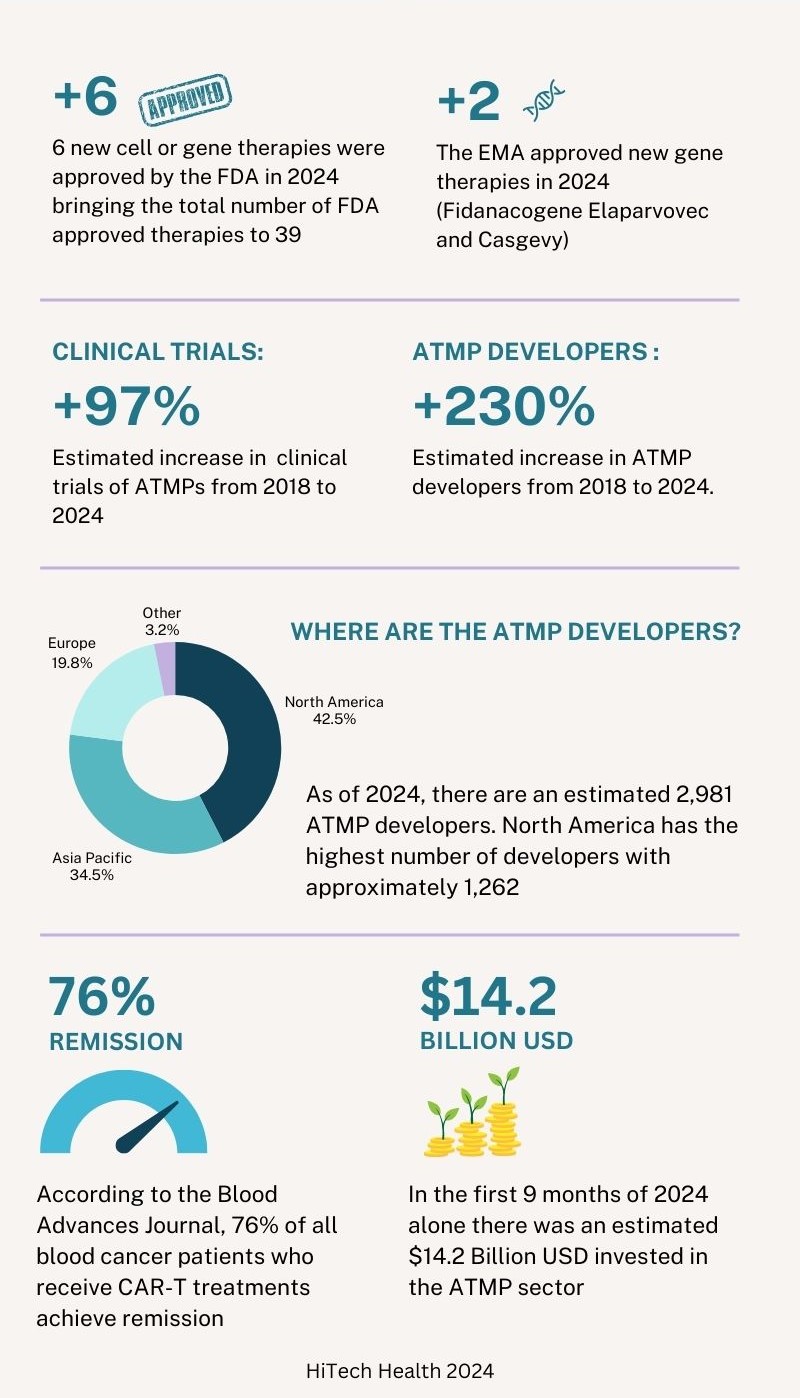

At the end of 2024, there were 39 cell and gene therapies approved in the United States by the FDA. Of the 6 new therapies approved by the FDA in 2024, 3 were gene therapies and 3 were cell therapies. In 2024 there have also been 2 new gene therapies approved by the European Medicines Agency (EMA). In addition to this, the FDA, EMA and other regulatory agencies are actively reviewing submissions made in 2024 and it is expected that a number of approval decisions will be made in the first quarter of 2025. The table below shows the therapies that were approved by the FDA and EMA in 2024.3

| Therapy | Type | Indication | Developer | Approval Status |

| Lifileucel | Cell Therapy | Metastatic Melanoma | Iovance Biotherapeutics | FDA approved 16 February 2024 |

| Lenmeldy | Gene Therapy | Metachromatic Leukodystrophy | Orchard Therapeutics | FDA approved 18 March 2024 |

| Fidanacogene Elaparvovec | Gene Therapy | Hemophilia B | Pfizer | FDA approved 27 April 2024

EMA approved 25 July 2024 |

| Tecelra | Cell Therapy | Advanced Synovial Sarcoma | Adaptimmune Therapeutics | FDA approved 1 August 2024 |

| Obecabtagene Autoleucel | Cell Therapy | B-Cell Acute Lymphoblastic Leukaemia | Autolus Therapeutics | FDA approved 8 November 2024 |

| Kebilidi | Gene Therapy | Aromatic L-Amino Acid Decarboxylase Deficiency | PTC Therapeutics | FDA approved 14 November 2024 |

| Casgevy | Gene Therapy | Sickle cell Disease and Beta-Thalassemia | Vertex Pharmaceuticals and Crispr Therapeutics | EMA approved 13 February 2024

(Previously approved by the FDA in late 2023 with an expanded label approval on 16 January 2024) |

Six years ago, in 2018, there were approximately 1000 clinical trials and 900 developers across the ATMP sector. By the end of the third quarter of 2024, the number of clinical trials has increased by approximately 97% in 6 years with an estimated 1,968 clinical trials. The number of developers has increased by approximately 230% during the same period to 2,981 developers. Of this estimated number of developers, 1,262 are based in North America, 1,036 are based in Asia Pacific, 587 are based in Europe and 96 are in other regions. Compared to the data in 2023, ‘other regions’ outside North America, Asia Pacific and Europe have seen the largest growth with an estimated yearly increase of 12.9% followed by Asia Pacific (12%), North America (6.6%) and Europe (3.3%).3

Similar to 2023, the majority of the clinical trials still involve cell-based therapies, accounting for approximately 70% of all trials. Oncology remains to be the most prevalent indication for ATMPs. Cancer patients, especially those who relapse, often must endure a series of arduous treatments using current standard of care chemotherapy and radiotherapy. CAR-T therapies have shown a reduction in collateral damage to healthy cells and can minimise side effects compared to traditional treatments. According to the Blood Advances Journal, 76% of all blood cancer patients who receive CAR-T treatments achieve remission. For B cell Lymphoma, overall survival is almost 9 times higher than the standard of care. Patients who receive Yescarta, a therapy used to treat B cell lymphoma, are 21% less likely to require subsequent treatment (insert reference: Vanderbilt University).3 4

Looking into the investments made in the ATMP sector, there was an estimated $13.3 billion USD invested 6 years ago in 2018 (excluding mergers and acquisitions (M&A) and grants). In the first 9 months of 2024, there has been a total estimated investment of $14.2 billion. At the time of writing, the data for the final 3 months of 2024 is not yet available but it is projected that the total annual investment will surpass $17 billion USD. There have been fluctuations in total investment over the last several years but the sector has shown robustness and positive investor sentiment. Across all regions, the largest type of investment is in the form of venture financing. North America has consistently seen the highest levels of investment since the industry was first developed.3

In Europe, in January 2022, Regulation (EU) 2021/2282 on health technology assessment (HTA) came into effect. The regulation aims to be applied in EU Member States by next month on the 12th January 2025. The HTA introduces an evidence‑based process that will allow the competent EU and national authorities to determine the effectiveness of new or existing health technologies, including cell and gene therapies. From 2025, all cell and gene therapies will undergo a single EU assessment of the value they add to patients and healthcare systems, aiming to end the need for 27 individual reviews. Companies will also meet jointly with the European Medicines Agency and Europe’s HTA coordinating group to discuss and align on the optimal clinical trial designs that deliver data, not only on safety and efficacy but also on added value to patients and healthcare systems.5

The regulation of ATMPs has progressed significantly in both the US, Europe and Asia Pacific regions over the last several years. In the US, the FDA has defined more transparent pathways for ATMPs, supported by the Regenerative Medicine Advanced Therapy designation, which facilitates expedited review and development support. The EMA has refined its guidelines for ATMPs, publishing a joint action plan with the European Commission to offer more streamlined processes for developers. There are opportunities for improvements in the regulatory pathways and we expect that the coming years will yield further changes. Developers are seeking more harmonised international regulations to help them navigate approvals across multiple regions more effectively. Notably, the regulatory agencies have also responded to the growing need for post-market surveillance, recognising the long-term nature of many ATMPs and the requirement for ongoing monitoring of their safety and efficacy.

2024 continues the trend of significant advances in the development and approval of new ATMPs which, ultimately, is great news for patients. The number of therapies receiving regulatory approval remains high with several applications still under review by the agencies. While there are challenges for ATMPs in manufacturing, pricing, and safety, the significant increase in the number of clinical trials demonstrates the potential of these medicines to enhance and transform patients’ lives. The outlook for the sector remains strong, with continued investment, technological innovation, and regulatory support propelling the industry forward in 2025 and beyond.

Hitech Health is a leading European CDMO and service provider for ATMPs. If you require support with the development and manufacturing of an ATMP, schedule a meeting with our team by emailing info@hitech-health.com.

References:

3 – https://alliancerm.org/data/